The key difference between Accounting vs Accounting is that Accounting is the process of recording, maintaining as well as reporting the financial affairs of the company which shows the clear financial position of company, whereas, the auditing is the systematic examination of the books of accounts and the other documents of the company to know that whether the statement shows true and fair view of the organizations.

Accounting vs. Auditing

Accounting is an act of maintaining the monetary records of a company in a way that they can help in the preparation of financial statements, which will give an accurate and fair view of the business of the company. As we note from Colgate’s SEC Filings, they are required to prepare the financial statements as per the regulatory authority guidelines.

Auditing, on the other hand, is the evaluation of financial records/statements prepared through the accounting function. The purpose is to ensure the reliability of the financial statements. In the case of Colgate, PricewaterhouseCoopers LLP audited the effectiveness of Colgate’s internal control over financial reporting in 2016.

In this article on Accounting vs. Auditing in greater detail –

What is Accounting?

Accounting is the language of business. Any business is measured in terms of numbers, and these numbers are arrived at employing accounting. Let us take simple examples of what kind of numbers are required by any businessmen on a day to day basis:

- What is the quantity of goods sold in the current month/quarter/year?

- What is the total cost incurred during the month/quarter/year?

- Is the company earning the profit or incurring heavy losses? In either case, what is the quantum of this profit/loss? What is the proportion of profit/loss as compared to the total sales?

- How much is the saving (positive saving will represent a benefit whereas a negative saving will denote that the company has spent more) in the cost as compared to last month?

- How many employees are currently employed in the organization?

- What is the profit margin of the company?

- What is the growth of the company over the past ten years?

- What is the total market share of the company?

- What is the profit of each retail outlet for the company?

The above questions can be answered, utilizing accounting. Accounting has various branches, such as:

#1 – Financial Accounting

The main focus of financial accounting is maintaining, processing, grouping, summarizing, and analyzing financial information of the company in a way that gives an accurate and fair view to various internal and external stakeholders of the company.

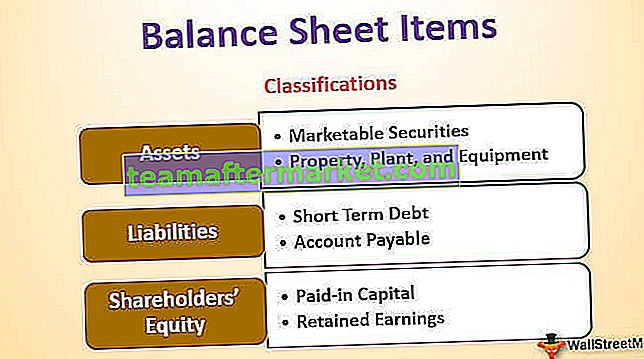

As we see from the below snapshot taken from Colgate 10K, the main focus of financial accounting is to prepare the financial statements, namely the Income Statement, Balance Sheet, and Cash Flow.

source: Colgate 10K Filings

Following is the graphical representation of the financial accounting process:

#2 – Cost Accounting

Cost accounting is beneficial from the point of view of costing various products. It helps to derive a cost price for complex products that require various raw materials, processes, and ingredients in its manufacture. It also helps to identify the key costs (fixed and variable) associated with each product and the break-even point for the products.

This serves an essential purpose for any given company. It derives a cost, which in turn helps to calculate the selling price of the product. The selling price will be derived on the basis of various parameters such as the margin percentage to be maintained by the company, the market competitiveness, strategy involved in selling the product, etc.

If you want to learn Cost Accounting professionally, then you may want to look at 14+ video hours of Course on Cost Accounting

#3 – Managerial Accounting

This section has more to do with planning and support decisions. The data organized by other fields of accounting are analyzed further to plan, make strategic decisions, and prepare a roadmap. Here, reports (MIS – Management Information System) are prepared on a daily/weekly/monthly basis for internal audiences such as the chief financial officer, chief executive officer, managers, and other top-level executives who make informed decisions on behalf of the company. The reports help them get a better perspective and make informed decisions. Some of these decisions involve – capital budgeting, trend analysis, forecasting, etc.

Some other types of accounting are Tax Accounting, Human Resource Accounting, Government Accounting, etc.

What is auditing?

Auditing is an activity of verification, checking, and evaluation of financial statements. As the financial statements are prepared on the basis of the accounting records of an organization, auditing covers the checking of accounting records as well.

It helps in determining the validity and reliability of accounting information represented by means of financial statements.

Auditing can be said to be more of a post-mortem activity. Once the process of financial accounting is completed for a given year, the process of auditing can start.

Auditing can be divided into External Audit and Internal Audit

| costing various products |

:

| costing various products |

Accounting vs. Auditing – Top 11 Differences

| Sr. No. | Point of Difference | Accounting | Auditing |

| 1 | Definition (Accounting vs. Auditing) | Accounting is an act of maintaining the monetary records of a company in a way that they can help in the preparation of financial statements, which will give an accurate and fair view of the business of the company. | Auditing is the evaluation of financial records/statements prepared through the accounting function. The purpose is to ensure the reliability of the financial statements. |

| 2 | Regulators (Accounting vs. Auditing) | Accounting Standards are issued by International Accounting Boards, which need to be adhered to while preparing financial statements. | Auditing Standards are issued by International Auditing Boards, which need to be adhered to while auditing financial statements. |

| 3 | Aim (Accounting vs. Auditing) | To provide an accurate and fair view of the financial statements to various users | To verify the reliability of the financial statement’s true and honest view |

| 4 | Main Categories (Accounting vs. Auditing) | A few sub-heads of accounting are as follows:

| Auditing can be bifurcated into:

|

| 5 | Key Deliverables (Accounting vs. Auditing) | Financial Statements is the critical deliverable of accounting, and the same comprises of the following:

| An audit report is a vital deliverable of auditing, and the same can be classified into the following:

|

| 6 | Work is performed by (Accounting vs. Auditing) | Bookkeepers and accountants | Auditors (It is essential for an auditor to have knowledge of accounting. Without thorough knowledge, an auditor cannot certify the financial statements. On the other hand, an accountant need not be well-versed with the auditing processes) |

| 7 | Key skills required (Accounting vs. Auditing) | Some of the critical skills needed by an auditor are:

| Some of the critical skills required by an auditor are:

|

| 8 | Day-to-day activities involved (Accounting vs. Auditing) | Daily operations of an accountant will include the following:

| Day-to-day activities of an auditor will involve the following:

|

| 9 | Level of responsibilities (Accounting vs. Auditing) | An accountant is part of the middle-level management of the organization. Here, the responsibility is to present a true and fair view of the financial position of the company to various stakeholders. Note: A thorough background check is required in this case as the accountant is in a position to manipulate the financial results of the company. | An auditor can be internal as well as external to the organization. In the case of an internal auditor, he/she will be part of the middle-level management of the organization. In the case of an external auditor, companies opt for certified auditing firms that are well-known in the industry. In a way, the level of responsibility of the auditor is more than the accountant. The report issued by them is a certification of the work done by the accountant. Note: A thorough background check is required, even in this case, because an auditor certifies the work of an accountant. If an auditor is not careful in performing his / her duties, there can be ample fraud opportunities to the accounting team. |

| 10 | Starting point (Accounting vs. Auditing) | Le point de départ de la comptabilité est la tenue de livres, c'est-à-dire la tenue de registres des affaires financières de l'entreprise, qui est ensuite utilisée pour préparer les états financiers de l'organisation. | L'audit commence lorsque le travail d'un comptable est terminé. Une fois les états financiers préparés, l'auditeur commence à vérifier l'exhaustivité et l'exactitude des états financiers. |

| 11 | Période (Comptabilité vs Audit) | C'est une activité permanente. Les états financiers peuvent être préparés sur une base trimestrielle et annuelle, mais l'enregistrement des écritures de journal et d'autres fonctions comptables est un processus continu. | C'est une activité périodique. Un audit annuel des états financiers est une exigence statutaire dans la plupart des pays. De nombreuses entreprises préfèrent également réaliser un audit trimestriel. |

Conclusion

La comptabilité et l'audit sont interdépendants et vont de pair. Le travail effectué par le comptable est certifié par le vérificateur. Le travail de l'auditeur n'aura aucun sens si le cadre comptable de base n'est pas établi dans l'organisation. De plus, s'il n'y a personne pour certifier le travail effectué par le comptable, il y aura une garantie quant à la fiabilité des données présentées dans les états financiers. Un auditeur ajoute de la valeur au travail effectué par les comptables.

En outre, les deux peuvent travailler main dans la main, en particulier en cas de mise en place de processus dans l'organisation. Les contrôles conçus et mis en œuvre par le comptable peuvent être testés par l'auditeur. Les lacunes de contrôle, le cas échéant, qui sont des domaines à haut risque, peuvent également être signalées par les auditeurs. Les auditeurs peuvent utiliser leur expérience et leur expertise et fournir des suggestions / solutions réalisables pour l'amélioration des processus. Celles-ci peuvent être mises en œuvre par le comptable pour une meilleure gestion des risques.

Ces contrôles internes, qui sont fixés conjointement par les comptables et les auditeurs, sont généralement approuvés par la direction. Ils peuvent être aussi simples qu'un système manuel de fabricant-vérificateur où un fabricant préparera un document (par exemple, un bon en espèces) et le fera approuver par un supérieur. Ces contrôles peuvent également être aussi complexes qu'une fonctionnalité intégrée dans l'ERP, qui mettra en évidence et interdira la création d'un grand livre de fournisseur en double en vérifiant le numéro d'identification unique de l'entreprise.